Garima Shah is an accomplished fintech executive with over 18 years of experience driving revenue growth and reshaping the payments industry. As President and Co-Founder of Biller Genie, a cloud-based platform that automates billing and invoicing processes, she scaled the company by expanding its subscriber base and fostering a high-performing company culture.

Before Biller Genie, she played a pivotal role in major acquisitions, including guiding Direct Connect through a management recapitalization and sale to Priority Payment Systems. She has also held leadership roles at Century Payments and eMerchantPay.

Garima is recognized in the financial technology sector with honors including NYC Fintech Women’s CEO of the Year, ETA’s 40 Under 40, Orlando Business Journal’s 40 Under 40, and Forbes’ Next 1000 list of entrepreneurs redefining the American Dream. She is also the founder of Brown Girls on a Mission, an initiative created to support women of color in business and technology, reflecting her broader influence on efforts to build a more inclusive fintech landscape.

She is a sought-after speaker who shares insights on fintech, leadership, and entrepreneurship. Garima holds a BS from Boston University and an MBA from Rollins College. A lifelong dancer, she balances her fast-paced career with performances at Orlando Magic halftime shows. In her conversation with Her Agenda, she aims to inspire others and highlight her dedication to innovation, diversity, and gender equity.

Her Agenda: Explain Biller Genie, to people who don’t know much about invoices and fintech.

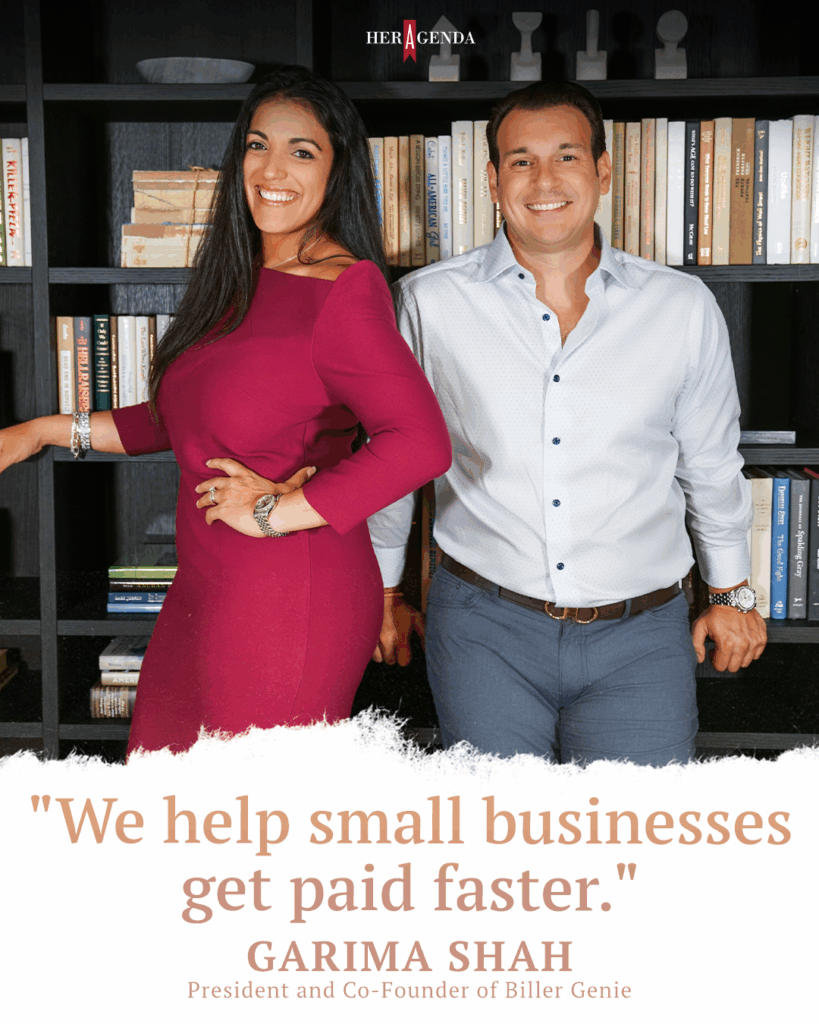

Garima Shah: I’m going to explain this in different ways. Fintech just means financial technology. [Thinking] about Uber, would you have gotten into someone random’s car at the airport 15 years ago? You wouldn’t have. [It’s] technology that makes that route work, [and how] they pay the drivers is fintech. Understanding that fintech is the movement of money across every ecosystem is important. It sounds like this buzzword, but it’s pretty simple. Most companies, or a lot of the new technology companies that are out there, are actually in that fintech space. In terms of what Biller Genie is, we are a super fancy way to say accounts receivable automation. We help small businesses get paid faster. If you think about your average landscaper [or] your pool company, [they] receive all these bills all the time. It takes an average of 47 days for the average U.S. business to get paid. On the Biller Genie platform, we drop that down to eight. Of course, we’re a genie, so we’re magical. But it’s really because we do all of the other things. We handle the follow-ups, we handle the customization.

There are three things that we do well that every business needs to do, whether you’re using Biller Genie or not. You’ve got to send out your invoices on time. You’ve got to ensure that you’re sending to the right person with the right information, and you’ve got to make it easy for customers to pay. That’s what we do at Biller Genie. We take any bills that you have, we send them out for you, we add your logo, we add your branding, we ensure that the data is accurate and built to the platforms, and we give the Amazon-like experience. I shop on Amazon, not because it’s cheaper, it’s better, but because it’s so much easier. We give that experience to a small business’s customers to make it easy for their customers to pay, which is why people pay faster.

Her Agenda: What inspired you to go into this field?

Garima Shah: It was by accident. When I started, fintech didn’t exist. I was in sales in a company that I opened, and a Fintech company approached me, a payments company, asked me to run their sales, or outsource their sales to me. I fell in love with the idea of this ever-changing industry, where we were truly the ones behind the scenes, moving the money. I think that’s always been very exciting to me, and that’s why I’ve been in the field for about 20 years. With Biller Genie specifically, we didn’t ever go out to create a software company. Our goal was never, oh, we’re going to go build the next unicorn, we’re going to do this. [There was] a need in the market. Businesses are going out of business every day because of a cash flow. If we can help resolve this because of our payments knowledge and where we came from, let’s go ahead and create that for small businesses.

Her Agenda: So what are the struggles for women and minority women in STEM?

Garima Shah: It’s gotten a lot better. But when I first started in Fintech, I was the only woman, the only minority, and the youngest in every boardroom that I entered. For a long time, I thought that was hard. I didn’t love that I would hear ‘to only wear black’ and ‘don’t wear open-toed shoes.’ I’m a loud, sparkly pink personality, and I found that difficult. I think that for women, or any kind of [marginalized group], learning to own the space is what makes it so exciting, because you are probably the only one there or you may be one of the only ones. I was listening to ‘That’s Total Mom Sense,’ she had a podcast on ‘the only’ and there’s a book written about it as well. I love and use that [idea] of you’re going to meet 500 people who look a certain way… then you’re going to meet me. You’re going to remember me. I’m going to make sure that you remember me. Especially, in STEM careers in the STEM industry [asserting] that [idea] of: I do this. I’m great at it. Using that authenticity to drive you and being the only, generally makes you more memorable, generally makes you better. There is a higher bar, unfortunately, that you have to probably hit. But I think that it’s creating some evolution in our industry, and I think it’s great.

Her Agenda: Can you tell me more about Brown Girls on a Mission?

Garima Shah: Brown Girls on a Mission is a charity I started last year. It’s a 501c3. It’s about how minority women can make an impact. How can we come together and make an impact on the world? It’s not about writing checks. The reason I started Brown Girls on a Mission is that I was on the board of a few different charities, and they’re fantastic organizations, but it always came down to the gala and selling raffle tickets, and getting silent auction items. You felt a little disconnected from the actual work that was being done. As you go to all of these different events, people are so excited about being there, dressed all fancy, and half of them don’t even know what the cause is that they’re there to support. I wanted to know if you take a group of women, and you say: ‘We’re going to do the work, we’re going to do the hard things. We’re going to go volunteer. How much does that change, and how much does that move the needle?’ That’s really the mission of Brown Girls on a Mission: to not just write a check. It is a giving circle where 100% of whatever we take in as a membership goes directly to charities. We supported over seven local charities in the past year. We’ve given over $80,000 in donations. We have served over 1,600 hours of volunteer time. That to me is probably the most exciting metric [because] we’re just giving our time, and we’re getting in there and solving problems because you can’t keep throwing money at things. You have to have smart people in a room trying to help solve problems. I don’t think that that’s happening enough, and that’s the goal.

Her Agenda: What is the next milestone you’re trying to reach with Biller Genie and your company?

Garima Shah: We’ve crossed that elite group of less than two or three percent of startup companies that make it past five years and become profitable. That’s exciting. We doubled or tripled our revenue every single year. That will continue. We’re probably going to cross over 100 employees by next year. We’re about 75, 78 now, so it’ll probably cross over 100 employees. We’ve got some huge partnerships, a lot of AI initiatives that we’re launching in the next year. Our ultimate goal is we are going to be a unicorn that disrupts the industry within the next five years.

Her Agenda: Is there any raw advice that you have for girls out there?

Garima Shah: Be you. I always tell people to do a spot analysis, and I make my kids do this too. Do a spot analysis for yourself to understand what your zone of genius is and what your strengths are. What are you really good at? Then own that space. Know that you’re good at it, and focus on becoming the best at those things, focus on honing in and optimizing that zone of genius so that you can be the only in the room [and] be authentically you at all times.

[Editor’s note: This interview has been edited for length and clarity.]