According to Fortune, America is about to experience the Greatest Wealth Transfer in history, with Gen X and Millennials projected to inherit $124 trillion in assets. Lisa McCurdy is the Founder and Managing Partner of The Wealth Counselor, a boutique estate and asset protection law firm serving high-net-worth families with complex, multigenerational wealth.

With such a wealth of knowledge in transferring wealth from generation to generation, she sees the upcoming Great Wealth Transfer as more than just a wealth transfer. “We’re transferring more than just things, money, and assets. We are transferring values and principles that will provide guidance to the next generation.”

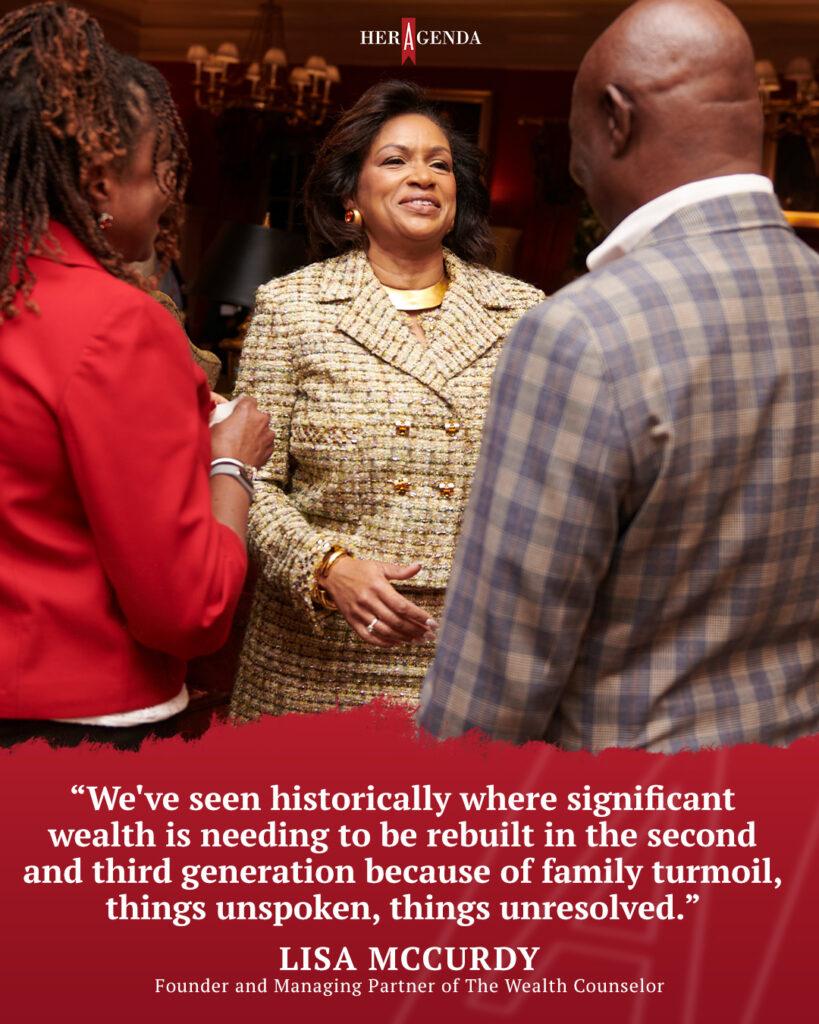

Women are set to inherit a majority of the wealth from their parents and their spouses. While talking with Lisa about this historical event, she emphasized the importance of making sure family estate plans are clearly established to prevent any devastating losses in wealth. She shared, “You know, we’ve seen historically where significant wealth is needing to be rebuilt in the second and third generation because of family turmoil, things unspoken, things unresolved.”

In this interview, Lisa shares her journey to becoming “The Wealth Counselor” and dives deeper into how our values, guiding principles, and wisdom shape how we build and preserve our wealth for the generations to come.

Her Agenda:A wealth counselor may be a term many folks have not heard before. We’d love to hear how you got started in your field.

Lisa McCurdy: It was very serendipitous because in law school, I didn’t plan to practice law traditionally. I thought I would use my degree for diplomacy or international relations, but I got the message that an elderly uncle was starting to exhibit signs of dementia. I’d chosen a field where I could really build a career, not just a job. I love research, critical thinking, advocacy, and writing, but my elderly uncle’s circumstances threw me for a loop. He wasn’t taking good care of himself. In order for a family member to step in to legally assist a loved one and speak with their financial institutions to make decisions about their care, they must establish an intervention case. I found out this all could be avoided by some important, but relatively painless, Trust and Estates documents. That eight-year period of service showed me a lot. I learned a lot of practical information. And I knew my very intelligent uncle, who had degrees and built a nice estate, would not have taken this path had he been better educated about a few tools. It changed the entire focus of my career.

Her Agenda:Is that something that you still see today in your work as well? Educated, but lacking crucial wealth-building and estate planning tools?

Lisa McCurdy: Absolutely, and it’s because our industry has led with death, dying, disability, so fear. That’s actually not a great motivator. At The Wealth Counselor, we are changing that focus. We are changing the conversation to empowerment, values, principles, wisdom, and impact. And when you shift a bit of the focus, you’re still making a lot of the same decisions, but your motivation is different. People feel better about showing up, taking action, and establishing a plan that is intentional and designed around their unique circumstances.

Her Agenda: As we think about our wealth, legacy, and families, what patterns or actions have you seen that actually keep us on track to protect and grow what we’ve built?

Lisa McCurdy: Well, you know, historically, women didn’t get to make those decisions. We were in the background, while our parents or spouses made those decisions for us. Unfortunately, some of those practices remain intact. I’m here to ensure women know they have the permission to take control of their wealth and that the power is in our hands. There is a significant shift in the control of wealth, from men to women. Women are inheriting through their husbands and through their inheritance. This is a wonderful opportunity for women to plan with intention – impact our communities, impact our families, and drive the conversation around causes that can shape the next several decades.

Her Agenda: I love that you mentioned that there is a major shift when it comes to wealth because the Great Wealth Transfer is a topic that has been in the media. How can women prepare for the Great Wealth Transfer, and what crucial steps can we take?

Lisa McCurdy: One is realizing that they have their own estate and their own ideas, and that they should be empowered to make decisions for themselves. We are preparing more prenuptial agreements for women. Today, some women are the wealthier of the spouses. Putting plans in place, establishing trusts, and establishing prenuptial agreements to separate the wealth of the businesses you’ve established prior to your marriage, so those assets remain protected and separate from marital assets. Of course, enjoy your marriage and build an estate with your spouse, but protect what you’ve already built too.

Her Agenda: You speak a lot about our values. Is this a part of a mindset that we should be adopting when it comes to building and preserving our wealth?

Lisa McCurdy: We tend to lead with our values and principles, but we don’t always know how to transfer that wisdom. Whether it’s through our estate plans, legacy plans, or our giving, we should frame our plan around our unique interests and our values and principles that we find most important. And you’ll hear the word ‘permission’ from me, because though we don’t think about it that way, many women are extremely giving, and sometimes we have to step back and realize that we’re in charge in every aspect of our lives – both our living legacies and our lasting legacies.

Her Agenda: Speaking of legacies, can you share more about your cohort LegacyMakers® and who makes up the community?

Lisa McCurdy: Often, it’s an executive woman who is respected by not only her nuclear family, but also multiple arms of the family tree, and she has taken on the task of helping the family to prepare plans to get their affairs in order. She is often in need of, or could benefit significantly from a group of others dealing with the same level of issues. There’s nobody supporting her, and she can benefit from some tools, a community of others surrounding her, and the expertise I can help offer to her to navigate.

Her Agenda: Lastly, what else should we know about estate planning and preserving our legacies?

Lisa McCurdy: Regardless of the size of your wealth, you should absolutely establish a plan in writing. Be intentional. Transfer your values and principles into that wisdom. It will be valuable to future generations. And don’t consider your plan as final. You will redraft, amend, and tweak your plan to align with the various stages of your life.

[Editor’s note: This article has been edited for length and clarity.]