What You Need To Know About Filing For Bankruptcy

The Administrative Office of the U.S. Courts recently released statistics showing that although bankruptcy filings in the United States remain below historical highs, they are steadily increasing.

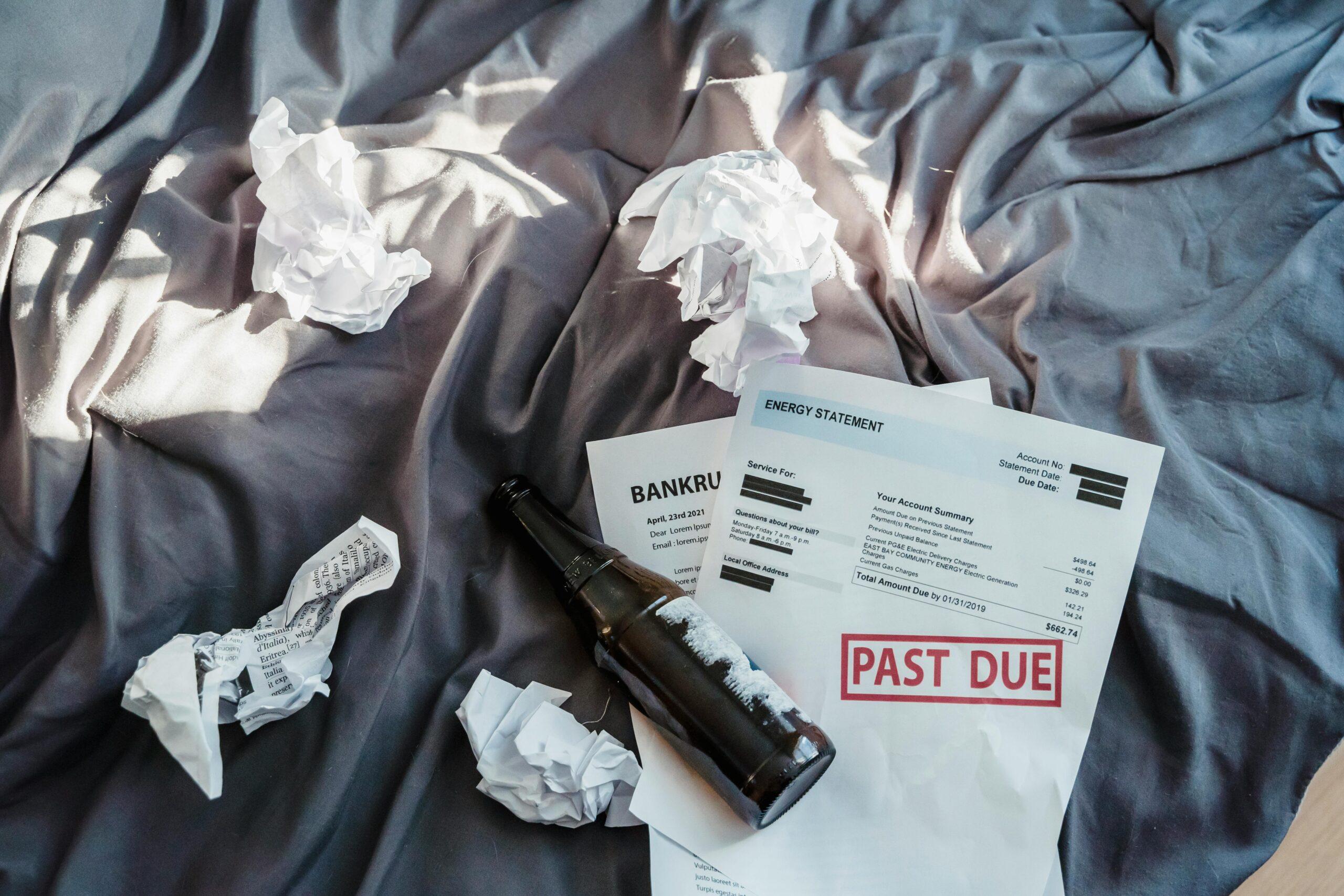

Declaring bankruptcy is a huge step, so much so that most financial experts hesitate to suggest it. But if you are considering it, here is what you need to know about filing for bankruptcy.

It Should Be The Absolute Last Resort

Experts like bankruptcy specialist New York City lawyer William W. Waldner warn of the long-term impact of bankruptcy. According to his website, understanding why bankruptcy affects credit reports requires acknowledging its long-term implications. Securing loans, whether for a car or a mortgage, becomes challenging after a bankruptcy.

If you are struggling with credit card debt, consider credit counseling with a certified, non-profit credit counselor, which you can find through the U.S. Trustee Program’s website. The Consumer Financial Protection Bureau also has a list of credit counselors and recommends debt consolidation, a debt management plan, or a debt settlement. However, be diligent about companies, as the site also warns of for-profit debt settlement companies, which can harm your credit and cost you significantly if they advise withholding payments while directing funds to a fee-based account to negotiate partial repayment with creditors.

It Stays With You For Years

According to CNBC, Chapter 7 bankruptcy can stay on your credit report for up to ten years, while Chapter 13 bankruptcy remains for seven years.

Karolina Grabowska

Which Type Of Bankruptcy To File

If all other debt options are exhausted, the first step is deciding which type of bankruptcy to pursue. The two most common for individuals are Chapter 7 and Chapter 11. Ben Luthi, a personal finance writer for Experians, explains that Chapter 7, or liquidation bankruptcy, requires forfeiting assets exceeding state-set limits. A bankruptcy trustee sells these assets to repay creditors. A means test determines eligibility by comparing your income to the state median and calculating disposable income.

Luthi advises that if you are ineligible for Chapter 7, you may file for Chapter 13 bankruptcy, which creates a three-to-five-year repayment plan, distributing monthly payments to creditors through a trustee.Chapter 11 bankruptcy, primarily used by businesses but also available to individuals with substantial debt, enables the retention of assets while reorganizing debts through a court-approved plan. However, it is the most complex and expensive bankruptcy option.

When to File for Bankruptcy

While filing should be an absolute last resort, when it should happen is essential, too.

“It makes sense to file if a creditor is going to be able to take away something you need,” Pamela Foohey, a law professor at the University of Georgia School of Law in Athens, tells CBS News. “If a person is dealing with a wage garnishment that is harming their lives, or if a lender is threatening to repossess your car. If there’s no other way to get a car that will fit your budget, filing could be a way to keep your car or keep your house.”

Foohey also notes that if you start a new job, file after you get hired, or if you have medical debt, wait until you are fully healed and well to file.

It Still Costs Money To File For Bankruptcy

Jennifer Streaks, a Personal Finance Expert and Business Insider journalist writes that while there is no one-size-fits-all, expect to pay anywhere from $300 to over $4,000 between the credit counseling, court filing, attorney, and miscellaneous fees.

“If you’re wondering how to handle your bankruptcy costs, some courts may allow you to pay the filing fee in installments or waive it altogether if you meet certain low-income requirements,” she writes.

She advises visiting your local bankruptcy court’s website for additional resources. If attorney fees are a concern, some lawyers may offer payment plans to make their services more affordable.

Past due notice

Resources

It will be beneficial to seek help from a financial professional, like a certified, non-profit credit counselor or bankruptcy lawyer. The Federal Trade Commission offers guidance on how to get out of debt. Streaks also published a comprehensive guide on the Best Debt Settlement and Debt Management Companies.

Check if your state, city, or county offers aid on the consumer finance website. Check out these resources from Heragena and the non-profit National Foundation for Credit Counseling organization.