Women And Latinx Founders Become Majority Business Owners In The U.S, White Men New Minority

For the first time in U.S. history, white men make up a minority of American business owners. This transformation is driven by rapid growth in women and Latinx-owned businesses.

12.5 million white male business owners comprise about 41% of the 30.5 million total small business owners in America. 11.6 million businesses are women-owned of which 35% are owned by women of color. And further, as revealed in this recent Forbes article announcing this milestone, “6.5 million businesses are owned by men of color, based on a recent analysis venture [capitalists] Seth Levine and [Elzabeth Macbride] conducted with the help of researchers from Stanford University using two sets of U.S. Census Bureau data from 2017, those for employer and non-employer businesses.”

“This is a really powerful opportunity for the country to prosper in the future,” said Jerry Porras, Co-Director of the Latino Entrepreneurship Program.

Turning The Tides

The number of women-owned businesses grew rapidly for decades as more women entered the workforce. Between 2018 and 2019, women opened up more than 1,800 businesses per day.

In the past five years, women-owned businesses grew at two times the rate of the overall population, and women of color have been starting businesses at 4.5 times the rate of the overall population.

Latinx-owned businesses grew two to four times the rate of the overall population since 2015. Porras estimates that there are 1 million new Latinx-owned businesses founded every five years.

“A key part of the Latino culture is owning a business,” said Porras. “People are entrepreneurial. They make do with what they’ve got. If it means starting a business, they start a business.”

He also explained that Latinos are not always able to generate wealth in ways that are typically expected. Going to college and climbing the corporate ladder is often not accessible to them for a myriad of systemic reasons.

An Overlooked Shift

U.S. Census Bureau analysis primarily focused on employer businesses, where white men are a declining proportion of owners, but still comprise about 60% of all business owners. Because of this, the large-scale demographic shift in the composition of America’s entrepreneurial class was largely overlooked. Narratives about business owners also tend to focus on a tiny minority of fast-growing tech companies.

Businesses that only employ a founder — but are still subject to federal tax — have been growing in both number and influence. Technological advances have made it easier to run a small business without hiring people.

And, to an extent, experts do argue that women and people of color are often excluded from the opportunity to expand their businesses. The option and ability to define their businesses in a separate category helps keep them small.

But this is not necessarily a positive, according to Makisha Boothe, founder and CEO of Colorado-based SistahBiz. She argues that assigning people of color-owned businesses into a category that, by definition, keeps them tiny, only serves to keep them there.

“Our women get put in the solopreneur zone,” Boothe said in a recent panel discussion. “It’s connected to access to capital. They simply don’t have the budget for bureaucracy and they don’t have the startup funds to move from solopreneur to boutique agency.”

As the regulatory burdens on small companies grow, the competitive landscape can become even more challenging.

Locked Out From Assistance

The problem with overlooking this demographic shift in the broad landscape is that it hinders systems from evolving so they can grow, and it keeps the U.S. economy reaping the benefits of that growth and creativity.

Long Pettine, founder of San Diego-based Ad Astra Ventures told Forbes that the system desperately needs to adapt to support these business owners.

She explained that on average, men and women business owners have very different attitudes towards risks. Men tend to define it only along financial lines, whereas women will consider risk across more avenues, including their relationships or their companies’ missions.

Pettine said women are forced to conform to patriarchal financial worlds that primarily reward the abilities to sell and project confidence, which can lead to many women faltering when speaking to venture capitalists.

“They may not come across as authentic in pitches,” Pettine said. “Venture capitalists are attuned to pick that up.”

Time to Adapt

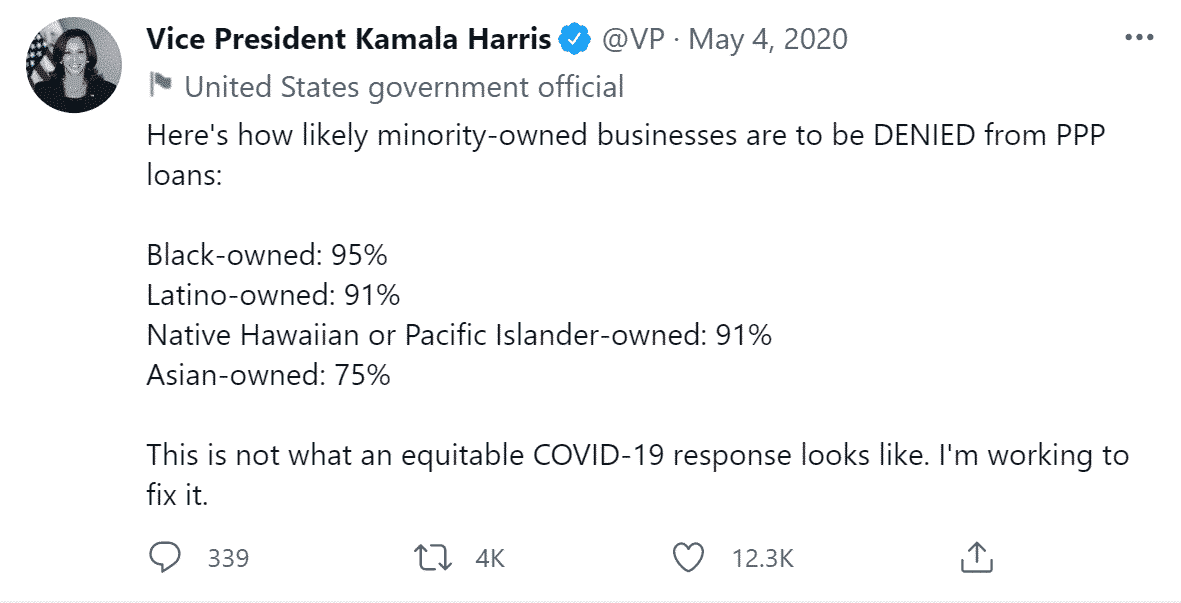

Small businesses, especially Latinx-owned businesses, suffered during the early months of the pandemic. Federal aid programs were designed for small businesses that had relationships with banks, a resource that many did not have access to.

Image: @VP on Twitter

Over 80% of today’s founders don’t get any outside financing at all.

“The pandemic demonstrated the key realities,” Porras said. “28% of white owned businesses secured PPP loans. 18% of the Latino-owned businesses secured them.”

Other demographic groups, including Black founders and women founders, were similarly disadvantaged.

Businesses and owners lose potential when entrepreneurs who don’t fit the mold are unable to climb the ladder of success. It’s likely that the nation has missed out on many innovations and job creations because the systems have not yet adapted.