How Salary Transparency Helps Women Empower Themselves At Work

At some point in your life, you’ve probably heard the adage, “Money can’t buy happiness.” Growing up you were perhaps even told to never ask how much someone makes or to discuss finances in social settings. These days, financial experts are sharing how disadvantageous not discussing money can be. The dogma that was planted in you as a child or teenager could now be contradicting the very essence of your financial success.

In a recent study, Empower, a financial services company, discovered that while 61% of Americans are thinking about finances constantly, 62% don’t speak on them openly. Even so, many of us are more familiar with our favorite celebrity’s financial status and net worth rather than taking inventory of our own. These numbers tell an important story and further shed light on the fact that more than 30% of Americans weren’t taught financial literacy and lacked the budgeting and financial planning tools that may have helped fill a gap.

Navigating talk on pay and salary is even more challenging for women. Empower shared that men feel more comfortable asking for a pay raise than women (74% vs. 59%), and research showed women are less comfortable talking about money with coworkers than men (36% women vs. 50% men). Outside of the pay gap women already experience, leaving money out of the conversation may be leaving money out of our pockets. It begs the question, is money truly the root of all evil, or is it the lack of financial confidence?

The more knowledge you have, the more comfortable and confident you’ll be discussing money-related topics, but this is just the first step. Being vocal about salary is an important step towards achieving pay equity, learning more, and breaking down gender-based wage gaps.

Before taking a seat at the next offer table, prepare by using these practical tips:

1. Know your worth.

Research the market rates for your position and experience level. Understand the value you specifically bring to the table and how it compares to industry standards.

2. Normalize salary discussions.

Take a deep breath before this one! Be open about conversations around salary. Chat with your peers, both within and outside your organization. By sharing information, you can gain insights into fair compensation and identify any discrepancies.

3. Seek out support networks.

Join professional organizations, online communities, or women’s groups where you can connect with others who have similar experiences. These networks can provide valuable advice, mentorship, and support when discussing salaries.

4. Practice negotiating.

Negotiation is an essential part of salary discussions. Prepare your case by highlighting your achievements, skills, and qualifications. Practice negotiating scenarios with a trusted friend or mentor to build confidence.

5. Be confident and assertive.

When discussing salary, approach the conversation with confidence. After all, they want you!

6. Lead by example.

Be proactive in initiating money-related discussions. Share your financial successes, setbacks, and strategies openly and responsibly. By leading with authenticity, you encourage others to do the same.

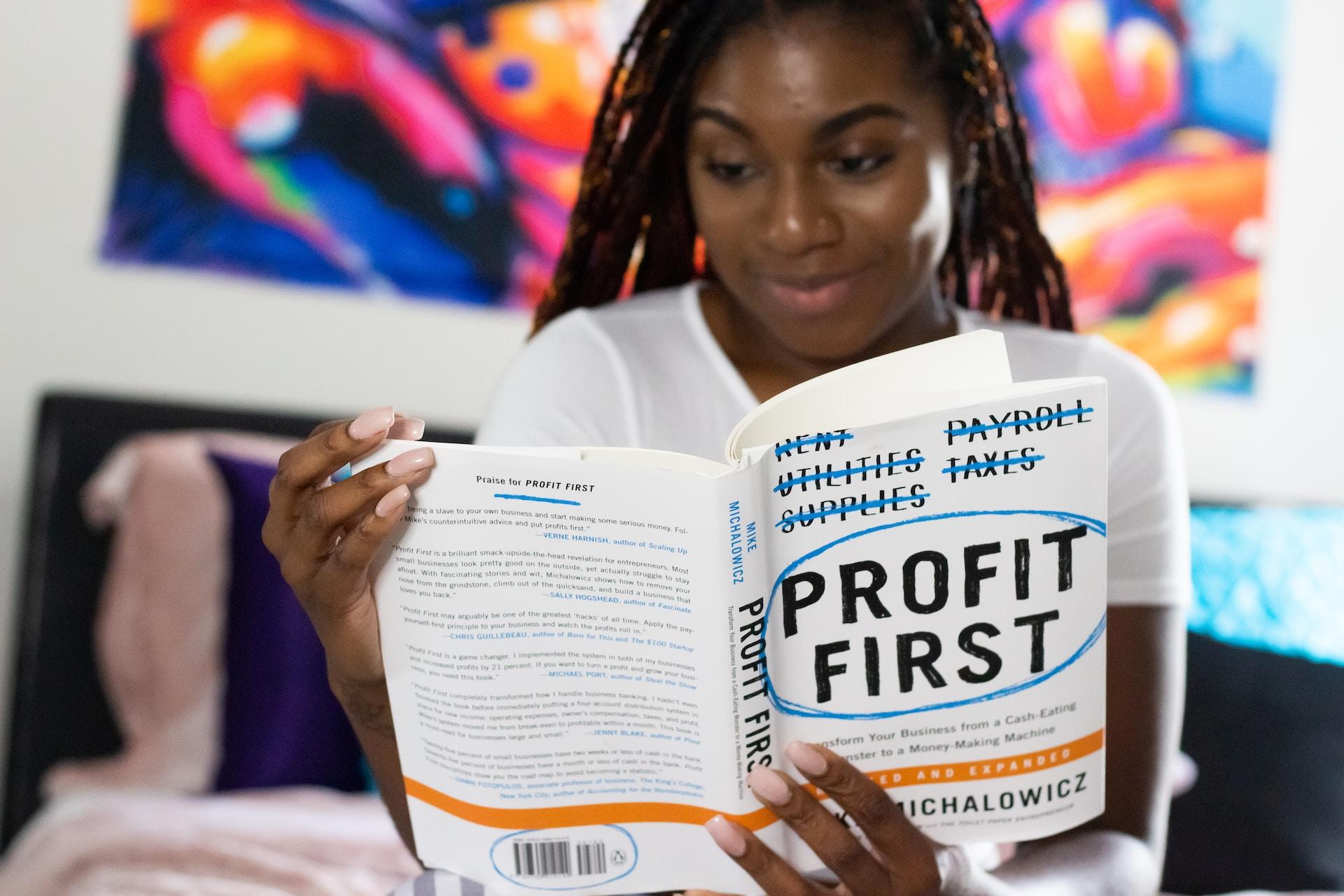

Educating yourself on money is key to breaking down the taboo. Although reading books, attending workshops, or taking courses on personal finance are investments, they pay off in the long run. For those who need one-on-one support or financial guidance, organizations like Operation HOPE help underrepresented groups and young adults own their finances to build literacy and competence.

Remember, normalizing conversations around money is a gradual process. It requires patience, empathy, and a willingness to challenge societal norms. By taking small steps and leading by example, you can contribute to a culture that encourages open and productive discussions about personal finance.