Women’s Retirement Roadmap: How To Plan A Successful Future

Retiring from work is a huge accomplishment for many people. This is because many people are unable to retire and are forced to work to keep food on the table. According to Zippia, today’s average retirement age is 64.7 for men and 62.1 for women, a jump from an average age of 57 in 1991. But fortunately, if you want to guarantee your retirement, you can create a women’s retirement road to ensure you remain on track to reach your goals.

What Is A Women’s Retirement Roadmap

When it comes to retirement, women — and especially Black women — face many barriers. This is particularly true as it relates to earnings. According to the American Association of University Women, Black women earn a whopping 67% less than white men. This wage gap translates into a tremendous difference in retirement savings and pension benefits.

Also, according to research, many Black women work for companies that don’t offer their employees retirement plans. This can make saving up for the future extremely challenging and, in many cases, impossible.

Luckily, this is where a women’s retirement roadmap can help. A women’s retirement roadmap is a plan of action that details the steps needed to guarantee a successful retirement.

Women’s Retirement Roadmap: How To Plan a Successful Future

When planning for retirement, it’s easy to overlook certain factors such as inflation and health care needs. But creating a women’s retirement roadmap is essential for ensuring your retirement expectations match your reality. By planning ahead, you can have peace of mind in knowing that you secured a healthy savings for your future. To learn how to prepare for a brighter tomorrow, here are six factors to consider when planning your women’s retirement roadmap:

Financial Goals

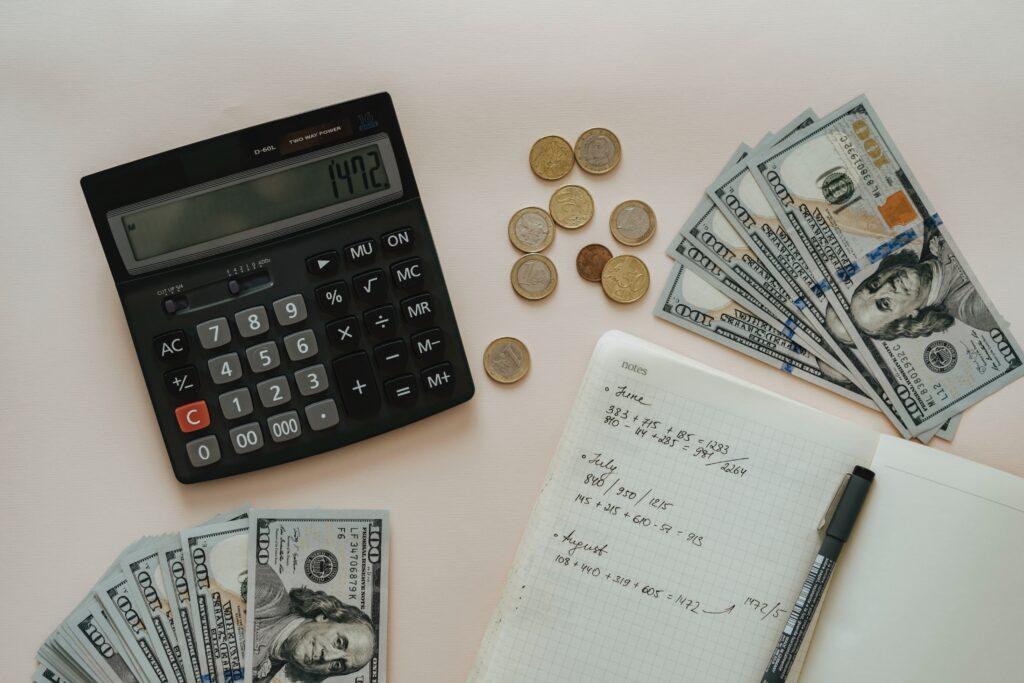

Planning your finances is the most significant step in creating a women’s retirement roadmap. This includes managing debt, creating a budget, and setting savings goals. That way, you can retire with enough savings to live comfortably.

Retirement Age

Your plan should also include a timeline outlining when you plan on retiring and how much savings you need to reach your goal. This can ensure that you remain on track to retire with enough time to enjoy the new chapter in your life.

Social Security

Before they kick in, familiarize yourself with your social security benefits, including how they work and when you can expect to receive them. It’s also helpful to research the multiple claiming strategies to better understand how each one impacts your retirement income.

Healthcare Costs

The older you get, the more likely you’ll need to secure adequate healthcare. When planning for retirement, factor in your healthcare expenses and consider every option, from Medicare to long-term care insurance.

Debt Management

Secure a greater future by reducing the amount of debt you have before you stop working. Doing so can help ease financial burdens when you have less income to fall back on.

Estate Planning

Create an estate plan to ensure your property and belongings are safe and secure after you pass. This also helps avoid confusion and fighting between family members over your assets.